NCJAR News

March is Women’s History Month, a time to honor the resilience, innovation, and leadership of women who have shaped industries, strengthened communities, and paved the way for future generations. In real estate, women have long been at the forefront of progress. At North Central Jersey Association of REALTORS®, we are proud to celebrate the extraordinary women whose leadership and dedication continue to move our organization and our industry forward.

March is Women’s History Month, a time to honor the resilience, innovation, and leadership of women who have shaped industries, strengthened communities, and paved the way for future generations. In real estate, women have long been at the forefront of progress. At North Central Jersey Association of REALTORS®, we are proud to celebrate the extraordinary women whose leadership and dedication continue to move our organization and our industry forward.

Real estate has provided generations of women with opportunities for entrepreneurship, financial independence, and community impact. From trailblazers who broke barriers decades ago to today’s leaders redefining excellence, women have transformed the profession into one built on collaboration, advocacy, and service.

At NCJAR, women are not only part of the story. They are leading it.

We recognize and celebrate the women serving in leadership roles across our Association, including our President, President-Elect, Officers, Board of Directors, Committee Chairs, and workgroup leaders. Your vision, integrity, and commitment to our members set the tone for excellence and professionalism throughout North Central Jersey.

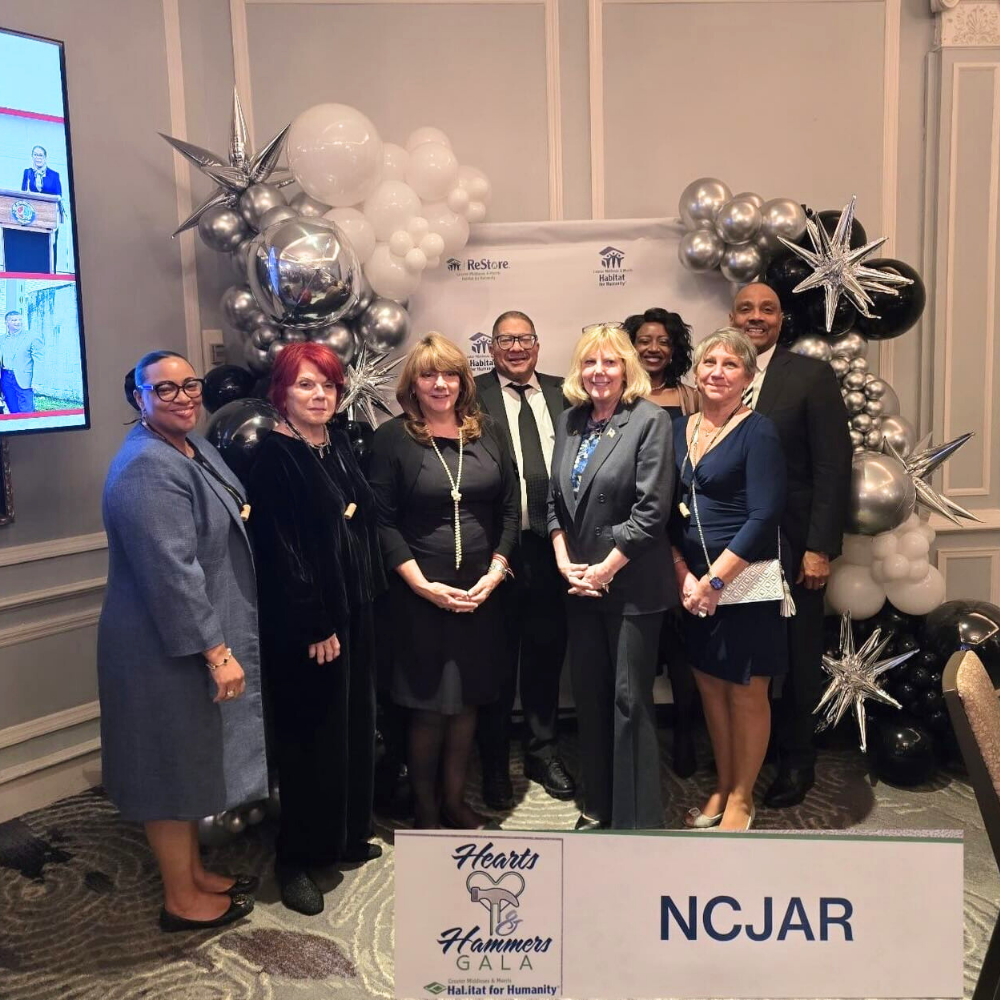

NCJAR Staff and Leadership were proud to attend and represent the North Central Jersey Association of REALTORS® at the 2025 Hearts & Hammers Gala held on Thursday, February 26, at The Westin Governor Morris in Morristown.

NCJAR Staff and Leadership were proud to attend and represent the North Central Jersey Association of REALTORS® at the 2025 Hearts & Hammers Gala held on Thursday, February 26, at The Westin Governor Morris in Morristown.

The evening was a true celebration of community, generosity, and impact. From inspiring stories that highlighted the life-changing work of Greater Morris Habitat for Humanity, to the exciting silent and live auctions, guests experienced a powerful reminder of what can be accomplished when a community comes together. The event also featured exceptional dining and wonderful company, creating an atmosphere filled with purpose and positivity.

NCJAR members gathered on February 25 at The Stirling Tavern in Morristown for an evening of connection, conversation, and community at our latest Networking Social.

NCJAR members gathered on February 25 at The Stirling Tavern in Morristown for an evening of connection, conversation, and community at our latest Networking Social.

From the moment guests arrived, the atmosphere was lively and welcoming. Attendees enjoyed delicious appetizers and an open bar while building new relationships, reconnecting with colleagues, and strengthening professional ties in a relaxed setting.

Please join us in welcoming Vanessa Neice to NCJAR as our new Multimedia Content Creator!

Please join us in welcoming Vanessa Neice to NCJAR as our new Multimedia Content Creator!

Vanessa brings creativity, energy, and a passion for storytelling to our team. She will be leading the development of engaging multimedia content that highlights our events, showcases our members, and strengthens the NCJAR brand across all platforms.

From capturing key moments to creating dynamic digital content, Vanessa will help us tell the story of NCJAR in fresh and exciting ways.

We’re thrilled to have her on board and can’t wait for you to see her work. Welcome to the team, Vanessa!