The latest data from the National Association of REALTORS® (NAR) brings promising news for the real estate market, as pending home sales saw a significant uptick in September. With all four major regions in the U.S. experiencing month-over-month growth in transactions, the Northeast and West are notably leading the charge with year-over-year increases as well.

The latest data from the National Association of REALTORS® (NAR) brings promising news for the real estate market, as pending home sales saw a significant uptick in September. With all four major regions in the U.S. experiencing month-over-month growth in transactions, the Northeast and West are notably leading the charge with year-over-year increases as well.

Key Takeaways for the Northeast Market

For NCJAR members, the Northeast region's growth is particularly relevant. In September, the Pending Home Sales Index (PHSI) for our region rose 6.5% month-over-month to reach 65.6, marking a 3.3% increase from the same time last year. This rise reflects increased activity and may signal more opportunities ahead as buyers responded to slightly lower mortgage rates and increased housing choices during late summer.

National Highlights and Market Trends

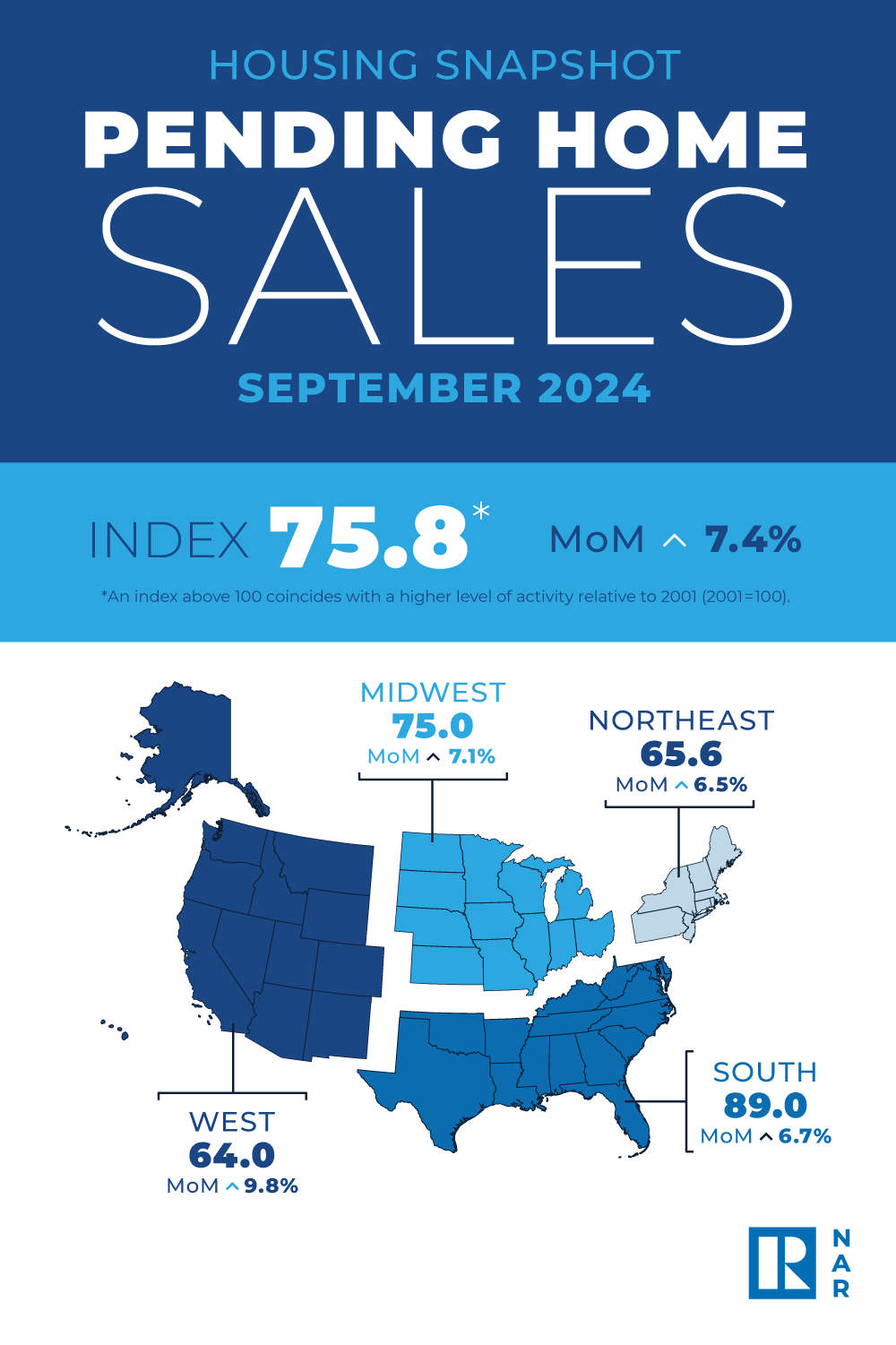

Across the U.S., the PHSI—a forward-looking indicator based on contract signings—jumped 7.4% from August, reaching 75.8. This is the highest level of pending sales since March and represents a 2.6% increase year-over-year. According to NAR Chief Economist Lawrence Yun, the recent growth in contract signings reflects buyer responsiveness to lower mortgage rates and broader inventory options, and he anticipates continued growth as long as the economy adds jobs, housing inventory rises, and mortgage rates remain stable.

NAR’s Economic and Housing Outlook

Looking further ahead, NAR’s forecast presents a cautiously optimistic picture for NCJAR members. Yun expects a moderation in home price appreciation over the next two years, with home sales projected to rebound after two slow years. Here’s what NAR anticipates:

- Sales Growth: Existing-home sales are projected to climb to 4.47 million in 2025 and exceed 5 million by 2026.

- Home Price Increase: Yun predicts a gradual rise in the median home price, reaching $410,700 in 2025 and $420,000 in 2026.

- Mortgage Rates: Mortgage rates are expected to fall slightly to 5.9% in 2025 before inching up again to 6.1% in 2026.

These projections indicate that although the market has faced challenges in recent years, there is a brighter outlook as supply increases and prices align more closely with consumer price growth.

Regional Performance Snapshot

Here's a closer look at the September 2024 regional breakdown:

- Northeast: The PHSI rose 6.5% from August and climbed 3.3% year-over-year to 65.6.

- Midwest: Sales surged 7.1% to 75.0, matching last year’s figures.

- South: Pending sales increased 6.7% to 89.0, remaining steady compared to 2023.

- West: The PHSI soared 9.8% month-over-month, marking a remarkable 12.3% increase from last year, reaching 64.0.

For NCJAR members, these numbers suggest the potential for greater transaction volume and price growth stability in the Northeast as we move into 2025 and beyond. With more favorable mortgage conditions likely to emerge and increased inventory options, we may see continued momentum in our region.

As always, stay tuned for ongoing updates and insights to help you make the most of emerging opportunities in the real estate market.