The latest report from the National Association of REALTORS® (NAR) shows encouraging signs for the U.S. housing market, with existing-home sales gaining momentum in October. This growth is reflected in all four major U.S. regions, though the Northeast remained steady year-over-year.

The latest report from the National Association of REALTORS® (NAR) shows encouraging signs for the U.S. housing market, with existing-home sales gaining momentum in October. This growth is reflected in all four major U.S. regions, though the Northeast remained steady year-over-year.

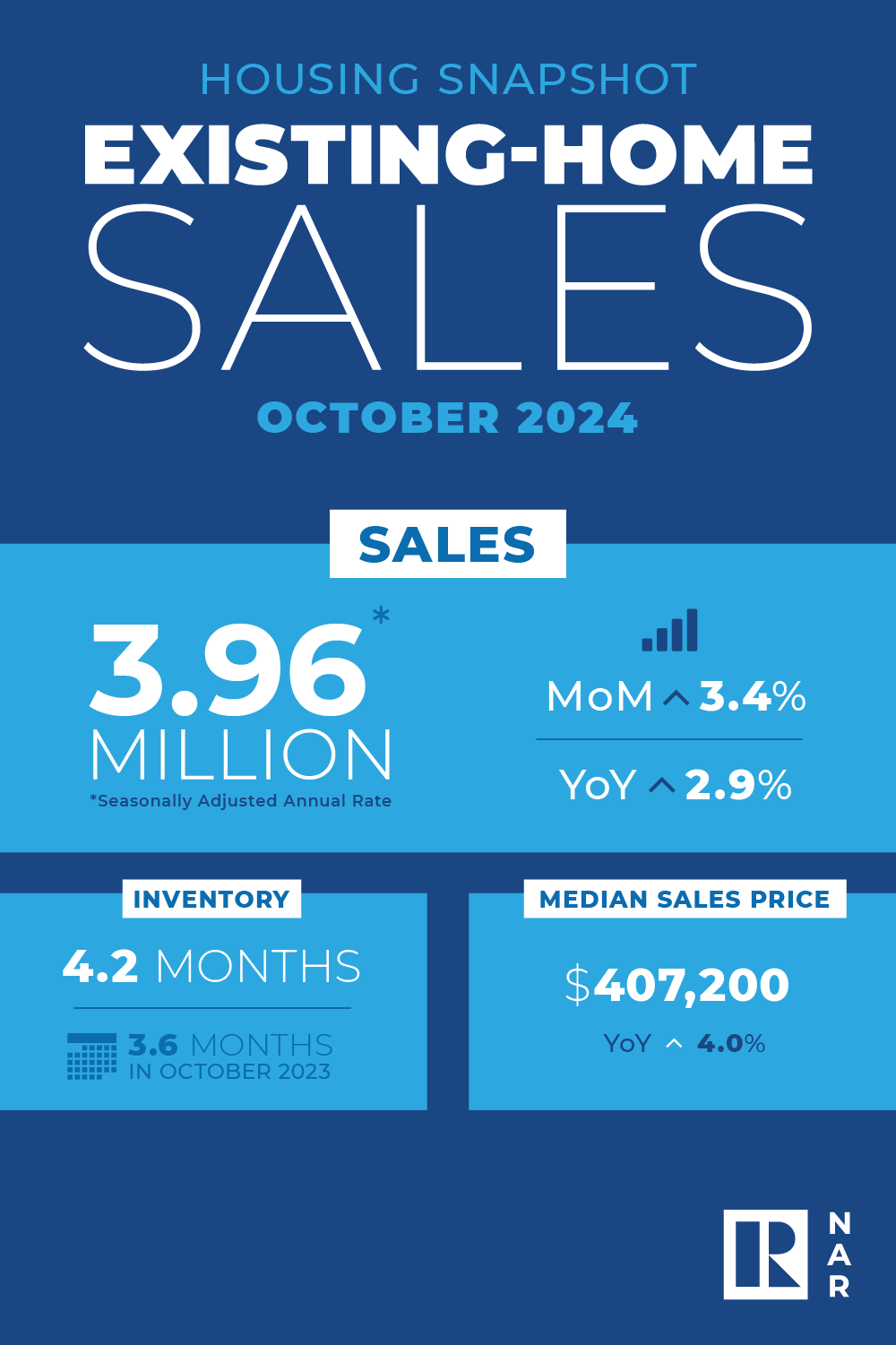

Key Highlights for October 2024:

-

Sales Growth:

Existing-home sales, including single-family homes, townhomes, condos, and co-ops, rose 3.4% from September to an annualized rate of 3.96 million. Year-over-year, sales increased by 2.9%.

NAR Chief Economist Lawrence Yun noted, “The worst of the downturn in home sales could be over, with increasing inventory leading to more transactions. Additional job gains and economic growth appear assured, fueling housing demand. Mortgage rates, while elevated, are expected to stabilize.” -

Inventory Trends:

Total housing inventory climbed to 1.37 million units, a 0.7% increase from September and a significant 19.1% rise compared to a year ago. Despite this growth, unsold inventory now sits at a 4.2-month supply, slightly lower than September but up from 3.6 months in October 2023. -

Home Prices:

The median price for existing homes reached $407,200, a 4% increase from October 2023. All four regions experienced price growth, continuing to bolster homeowners’ wealth nationwide.

Regional Performance: Northeast Holds Steady

While other regions reported year-over-year sales increases, the Northeast remained unchanged at an annualized rate of 470,000. Prices in the region surged 7.6% from the previous year, with a median home price of $472,900.

Market Dynamics: Buyer Activity and Financing Trends

-

First-Time Buyers:

First-time homebuyers accounted for 27% of October’s transactions, a slight uptick from September but a dip from 28% in October 2023. According to NAR’s latest report, the annual share of first-time buyers hit a record low of 24%. -

Cash Transactions and Investors:

Cash sales represented 27% of total transactions, a drop from September’s 30%. Investors and second-home buyers purchased 17% of homes, up slightly from September’s 16%. -

Distressed Sales:

Foreclosures and short sales remained stable, making up just 2% of total sales. -

Mortgage Rates:

The 30-year fixed-rate mortgage averaged 6.78% as of mid-November, a decrease from both the previous week and the same period last year (7.44%).

Looking Ahead: Stability and Opportunity

As inventory levels rise and home prices maintain steady growth, the market is poised for a more balanced trajectory in 2025. Yun expects increased homebuilding activity and additional inventory to moderate price gains, potentially improving affordability.

For NCJAR members, these trends offer critical insights into the evolving market landscape. Whether you're guiding first-time buyers or working with seasoned investors, staying informed about regional and national developments is essential for success.