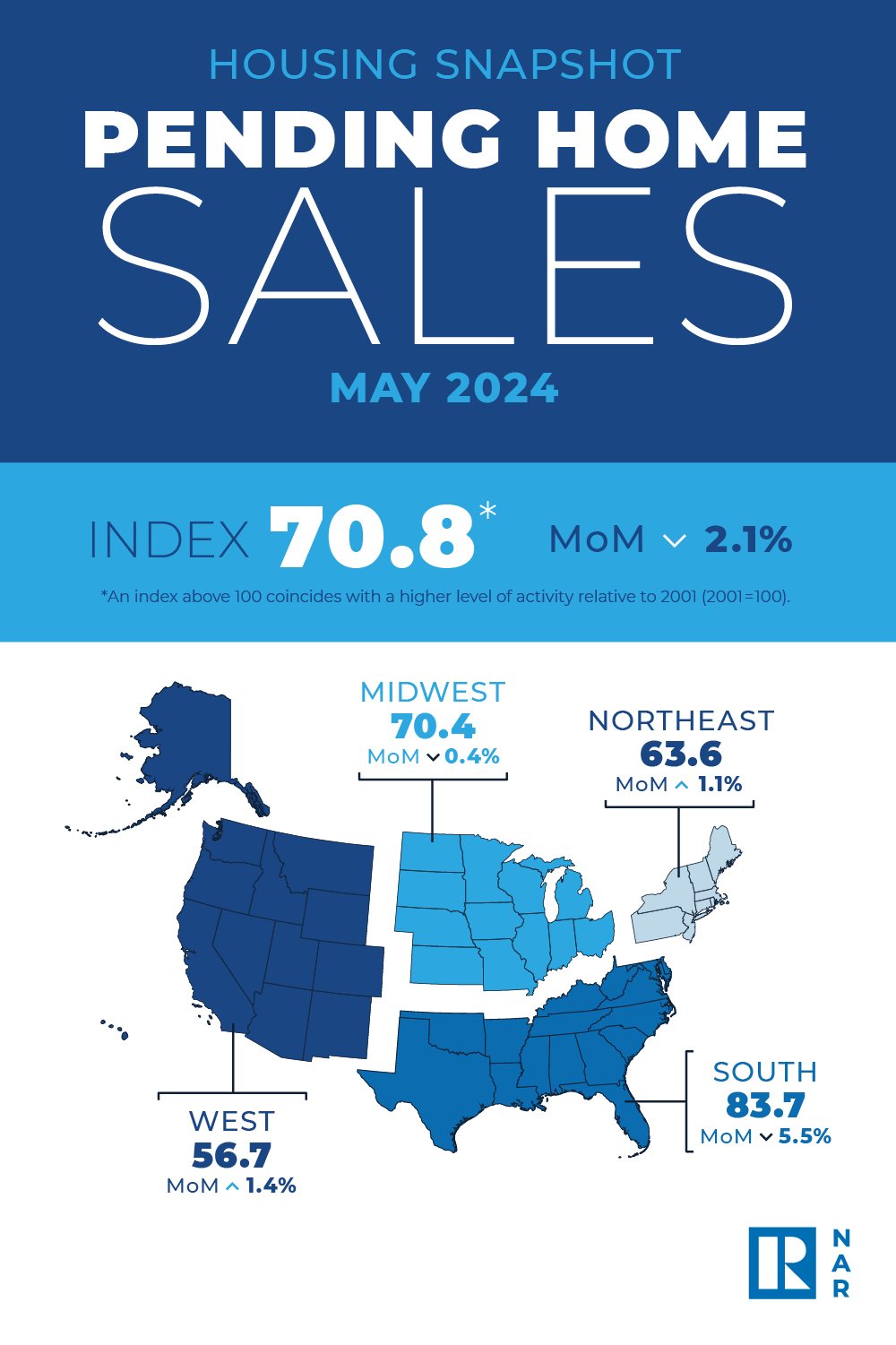

In May, pending home sales experienced a slight decline of 2.1%, as reported by the National Association of REALTORS® (NAR). This decrease was primarily driven by monthly losses in the Midwest and South, while the Northeast and West saw gains. However, when looking at year-over-year data, all U.S. regions recorded reductions in pending home sales.

In May, pending home sales experienced a slight decline of 2.1%, as reported by the National Association of REALTORS® (NAR). This decrease was primarily driven by monthly losses in the Midwest and South, while the Northeast and West saw gains. However, when looking at year-over-year data, all U.S. regions recorded reductions in pending home sales.

Key Highlights:

- Pending Home Sales Index (PHSI):

- The PHSI, a forward-looking indicator based on contract signings, decreased to 70.8 in May.

- This represents a 6.6% drop in pending transactions compared to the same month last year.

- For context, an index of 100 corresponds to the level of contract activity in 2001.

NAR Chief Economist Lawrence Yun noted, “The market is at an interesting point with rising inventory and lower demand. Supply and demand movements suggest easing home price appreciation in upcoming months. Inevitably, more inventory in a job-creating economy will lead to greater home buying, especially when mortgage rates descend.”

U.S. Economic Forecast

NAR projects that mortgage rates will stay above 6% through 2024 and 2025, even with anticipated Federal Reserve rate cuts. Here are some key forecasts:

-

Existing-Home Sales:

- Expected to rise to 4.26 million in 2024 (up from 4.09 million in 2023).

- Further increase to 4.92 million in 2025.

-

Housing Starts:

- Predicted to grow to 1.382 million in 2024 (from 1.413 million in 2023).

- Expected to rise to 1.492 million in 2025.

-

Home Prices:

- Median existing-home price forecasted to reach $405,300 in 2024 (up from $389,800 in 2023).

- Further increase to $412,000 in 2025.

- Median new home price expected to increase to $434,100 in 2024 (from $428,600 in 2023), and to $441,200 in 2025.

Yun elaborated, “The first half of the year did not meet expectations regarding home sales but exceeded expectations related to home prices. In the second half of 2024, look for moderately lower mortgage rates, higher home sales, and stabilizing home prices.”

Regional Breakdown of Pending Home Sales

-

Northeast:

- The PHSI rose 1.1% from last month to 63.6, though it’s a 2.3% decline from May 2023.

-

Midwest:

- The index fell 0.4% to 70.4 in May, down 5.6% from one year ago.

-

South:

- The PHSI dropped 5.5% to 83.7 in May, a 10.4% decrease from the previous year.

-

West:

- The index increased by 1.4% in May to 56.7, but this is still a 2.1% decline from May 2023.

Stay informed and adapt to these market changes to better serve your clients. For more detailed insights and to stay updated with the latest market trends, keep an eye on future communications from NCJAR.

Source: National Association of REALTORS®