In April, existing-home sales experienced a slight decline across the United States, as reported by the National Association of REALTORS® (NAR). All four major U.S. regions saw month-over-month decreases. However, the West was the only region to post a year-over-year increase in sales.

In April, existing-home sales experienced a slight decline across the United States, as reported by the National Association of REALTORS® (NAR). All four major U.S. regions saw month-over-month decreases. However, the West was the only region to post a year-over-year increase in sales.

National Overview

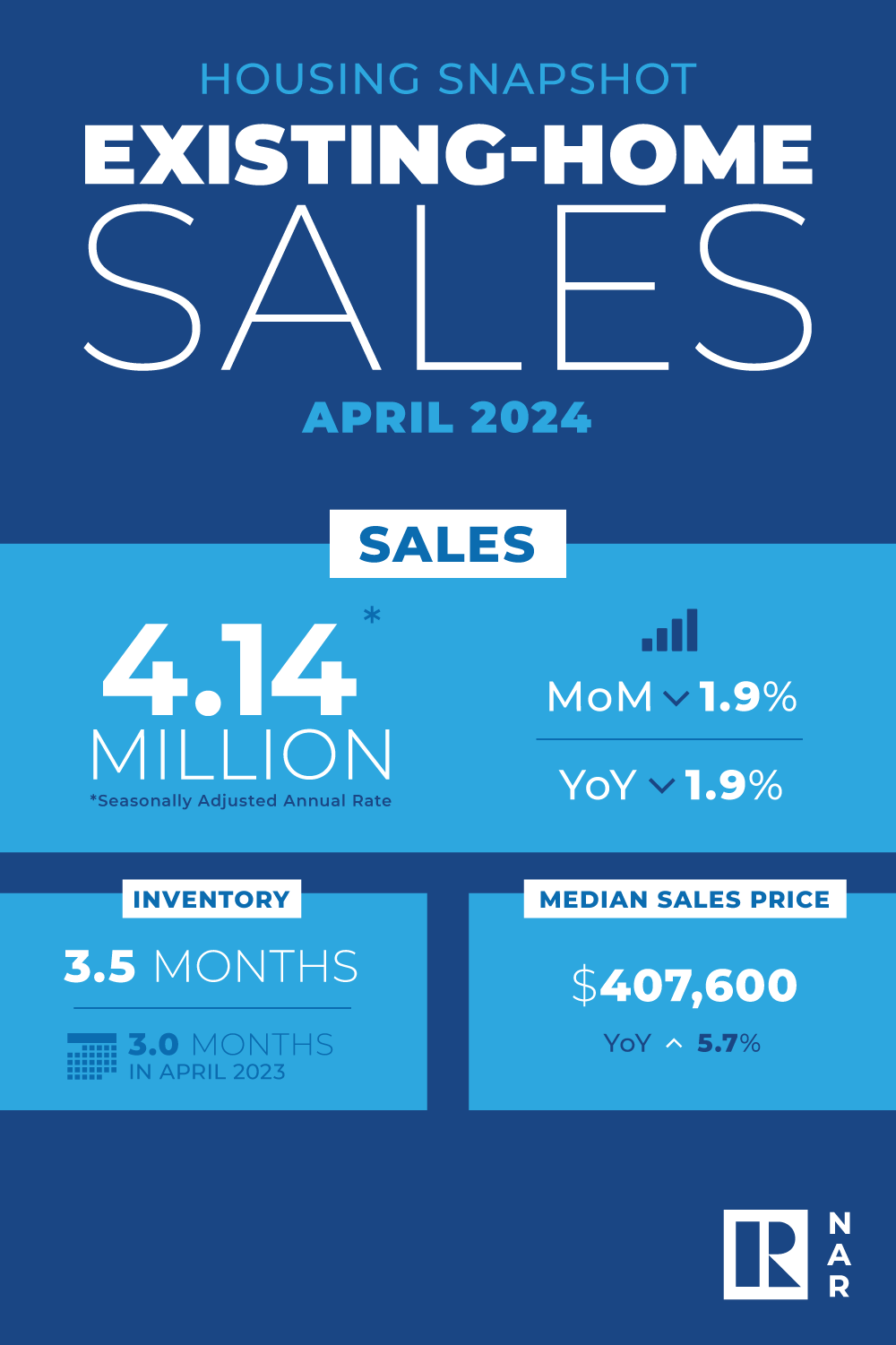

Total existing-home sales, which include single-family homes, townhomes, condominiums, and co-ops, dropped by 1.9% from March, reaching a seasonally adjusted annual rate of 4.14 million in April. Compared to April 2023, sales also fell by 1.9%, down from 4.22 million.

NAR Chief Economist Lawrence Yun noted, "Home sales changed little overall, but the upper-end market is experiencing a sizable gain due to more supply coming onto the market."

Inventory and Prices

At the end of April, total housing inventory rose to 1.21 million units, a 9% increase from March and a significant 16.3% rise from the previous year. The unsold inventory now represents a 3.5-month supply at the current sales pace, compared to 3.2 months in March and 3.0 months in April 2023. Notably, for homes priced at $1 million or more, both inventory and sales saw substantial increases of 34% and 40%, respectively, from a year ago.

The median existing-home price for all housing types in April was $407,600, a 5.7% increase from last year. Every U.S. region experienced price gains, marking a record high for the month of April.

Yun added, "Home prices reaching a record high for the month of April is very good news for homeowners. However, the pace of price increases should taper off since more housing inventory is becoming available."

Market Dynamics

According to the REALTORS® Confidence Index, properties typically stayed on the market for 26 days in April, a decrease from 33 days in March but an increase from 22 days in April 2023. First-time buyers accounted for 33% of sales, a slight rise from 32% in March and 29% a year ago.

All-cash sales made up 28% of transactions, consistent with March and the previous year. Individual investors or second-home buyers, who often pay in cash, purchased 16% of homes, up from 15% in March but down from 17% in April 2023. Distressed sales, including foreclosures and short sales, remained steady at 2% of total sales.

Mortgage Rates

Freddie Mac reported that the 30-year fixed-rate mortgage averaged 7.02% as of May 16, down from 7.09% the previous week but up from 6.39% one year ago.

Regional Sales Breakdown

- Northeast: Sales decreased by 4% from March, with an annual rate of 480,000. Year-over-year, sales also fell by 4%. The median price rose by 8.5% to $458,500.

- Midwest: Sales slipped by 1% from March, with an annual rate of 1 million. Year-over-year, sales decreased by 1%. The median price increased by 6% to $303,600.

- South: Sales dropped by 1.6% from March, with an annual rate of 1.9 million. Year-over-year, sales declined by 3.1%. The median price went up by 3.7% to $366,200.

- West: Sales decreased by 2.6% from March, with an annual rate of 760,000. However, year-over-year sales increased by 1.3%. The median price surged by 9.3% to $629,600.

The housing market continues to evolve with varied trends across different regions. While sales have generally receded, the increase in inventory, especially in the higher-end market, and the rise in median home prices provide an optimistic outlook. For REALTORS® in our area, staying informed about these dynamics is crucial for advising clients and making strategic decisions in the current market environment.

Stay tuned for more updates and insights from NCJAR to help you navigate these changes effectively.