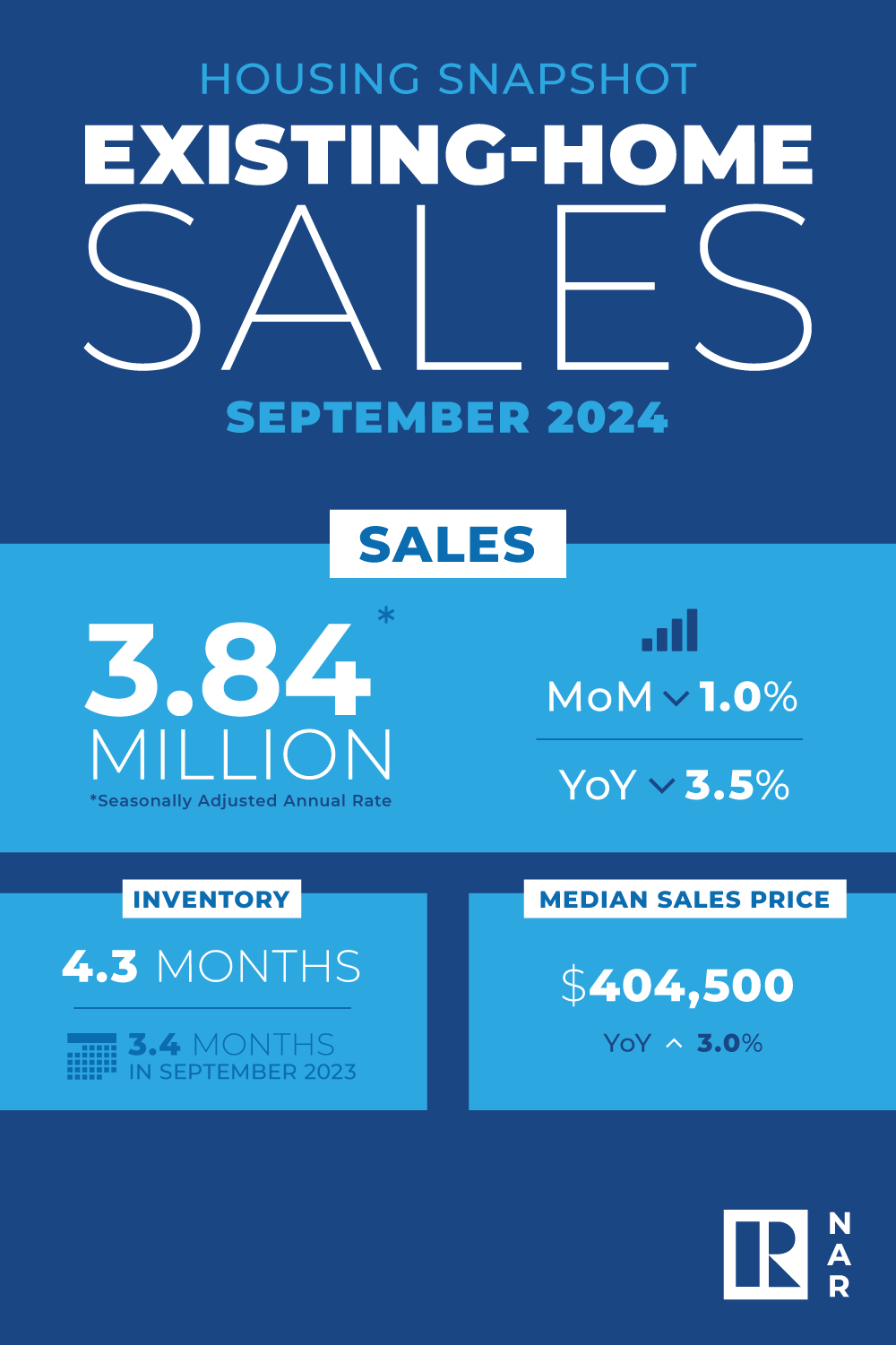

The housing market saw a slight dip in existing-home sales in September 2024, as three out of four major U.S. regions experienced declines, according to the National Association of REALTORS® (NAR). Total sales, which include single-family homes, townhomes, condominiums, and co-ops, fell 1.0% from August to a seasonally adjusted annual rate of 3.84 million, marking a 3.5% decrease year-over-year.

The housing market saw a slight dip in existing-home sales in September 2024, as three out of four major U.S. regions experienced declines, according to the National Association of REALTORS® (NAR). Total sales, which include single-family homes, townhomes, condominiums, and co-ops, fell 1.0% from August to a seasonally adjusted annual rate of 3.84 million, marking a 3.5% decrease year-over-year.

While this overall decline continues the trend of a slower market, there is some positive news for both REALTORS® and their clients. NAR Chief Economist Lawrence Yun highlighted that factors like increased inventory, lower mortgage rates compared to last year, and a growing job market may signal potential improvement ahead.

Inventory Boost Brings Hope for Buyers

The total housing inventory at the end of September reached 1.39 million units, a 1.5% increase from August and a significant 23.0% jump from one year ago. This uptick in available homes translates to more options for buyers, a trend that can help alleviate some pressure in this competitive market. The unsold inventory now sits at a 4.3-month supply at the current sales pace, compared to just 3.4 months in September 2023.

For NCJAR members, this increase in inventory is crucial, especially in a market where distressed properties remain rare. Yun noted that with mortgage delinquency rates remaining low, distressed sales accounted for only 2% of all transactions last month.

Prices Continue to Rise, but at a Slower Pace

Despite the dip in sales, home prices continue to rise, albeit at a more moderate pace. The median existing-home price across all housing types in September was $404,500, up 3.0% from the previous year. Notably, the Northeast saw a robust 6.0% price increase, with the median price reaching $467,100.

Yun pointed out that moderating price increases are welcome news for buyers, especially as wage growth begins to outpace home price appreciation. This shift could improve housing affordability, an essential development for first-time homebuyers who accounted for just 26% of sales in September, matching the all-time low from August.

Regional Performance: A Mixed Bag

The West was the only region to see an increase in existing-home sales, rising 4.1% from August and 5.6% year-over-year. In contrast, the Northeast, Midwest, and South experienced declines:

- Northeast: Sales fell 4.2% from August, down 6.1% year-over-year.

- Midwest: A 2.2% decrease from August, down 5.3% year-over-year.

- South: Sales slipped 1.7% from August, down 5.5% year-over-year.

These figures indicate varying market conditions across the country, which NCJAR members should keep in mind as they guide clients through real estate decisions.

What’s Next?

With mortgage rates slightly lower than a year ago but still elevated compared to historical norms, buyers and sellers may be cautiously waiting to see how the market and the upcoming election impact the economy. Yun speculated that some consumers may be hesitating before making a major financial commitment like buying a home, but the combination of increasing inventory and moderating prices offers hope for more balanced market conditions in the future.

For NCJAR members, understanding these trends is essential to providing clients with informed, strategic guidance. While challenges persist, opportunities remain for those ready to navigate the shifting real estate landscape. Keep these insights in mind as you prepare for the final months of 2024 and beyond.